- CoinGape Newsletter

- Posts

- 📢 Crypto Catch-Up: Weekly Rundown of Market Mayhem

📢 Crypto Catch-Up: Weekly Rundown of Market Mayhem

This week marked a turning point for crypto. Regulatory clarity arrived with the U.S. passing its first stablecoin law, Ethereum surged on ETF momentum, and market turbulence triggered over $700M in liquidations. While macro headwinds and security risks stirred caution, institutional moves and policy shifts signalled a maturing market bracing for its next phase.

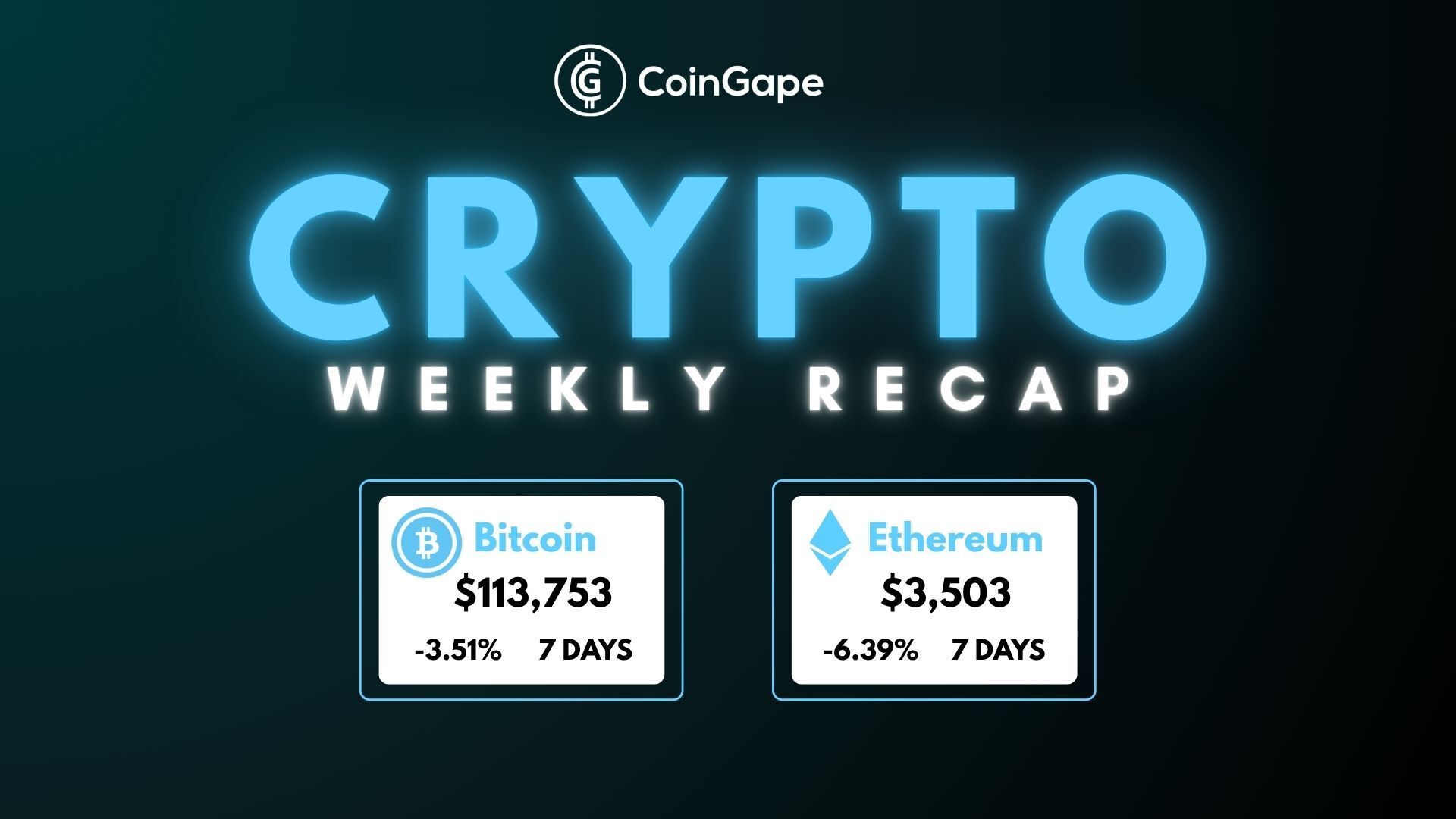

🔻BTC down 3.51%, ETH down 6.39% 🔻

Market Overview 📊

🟠 Bitcoin: ~$113,700

🟣 Ethereum: ~$3,500

⚫️ Altcoins:

XRP: ~$2.93

Solana: ~$164

Cardano: ~$0.71

BNB: ~$755

Dogecoin: ~$0.19

Shiba Inu: ~$0.00001

📊 Fear & Greed Index at 51 — Market sentiment is neutral, with no strong fear or greed driving direction right now.

🔍 Core Insights:

💥 $708M+ in Crypto Liquidations Hit Market

Over $708 million in crypto positions were liquidated this week as sharp price drops across Bitcoin and major altcoins triggered mass selloffs. The bulk of these liquidations came from long positions, reflecting overly bullish sentiment ahead of a market correction. This marks one of the largest single-week liquidations in recent months and highlights rising volatility and risk-off behaviour among traders.

📉 SOL Slides: Whale Moves $17M+ SOL, Crash to $120 Targeted

Over the past week, Solana slumped about 12%, with price now hovering just above $160. A whale offloaded more than $17 million in SOL, while a record $57 million in long positions was liquidated, signalling trouble. With a bearish rounding-top forming and next support at $159, analysts warn that a breakdown could send SOL tumbling toward a $120 target.

🧱 GENIUS Act Signed: U.S. Creates First Stablecoin Rules

The GENIUS Act, signed into law on July 18, sets the first U.S. rules for stablecoins, requiring 1:1 backing, audits, and licensing, bringing much-needed regulatory clarity to the space.

🚀 ETH Surges Over 54% in July on ETF Flows & DeFi Boom

Ethereum chalked up a staggering +52% to +67% surge in July, fuelled by record-breaking spot ETF inflows, over $5.4 billion driven by institutional appetite and solid DeFi growth and real‑world asset tokenization accelerating on-chain usage and demand.

🚨 Crypto in 401(k)? Trump Admin Considers Including Digital Assets

The Trump administration is preparing an executive order to allow cryptocurrencies to be included as investment options in 401(k) retirement plans, following the Department of Labor’s rollback of 2022 guidance that discouraged crypto offerings. This marks a pivotal shift toward broader access, though experts warn of potential reputational and regulatory risks.

What's Next? ⏩

Next week, crypto may stay volatile as macro pressure lingers, but Bitcoin’s support and Ethereum’s strength hint at limited downside. Regulatory clarity could invite fresh institutional interest, though security concerns and recent liquidations may keep the market in cautious consolidation.

📬 Catch you next week. Same time, same vibes, with the hottest crypto news!