- CoinGape Newsletter

- Posts

- 🚨 Crypto Pulse: What’s Popping in the Markets Today?

🚨 Crypto Pulse: What’s Popping in the Markets Today?

📰 News

Crypto exchange Kraken and Backed have moved to launch the tokenized equities xStocks on the Binance Chain, enabling multichain access.

Kraken To Launch Tokenized Equities On Binance Chain

In a press release, the crypto exchange announced that, in conjunction with Backed, it has entered into a strategic partnership with Binance Chain. As part of the partnership, the BNB network will join the Stock Alliance, in a move that boosts on-chain access to tokenized US stocks for users globally.

In the coming weeks, eligible clients will be able to deposit and withdraw these stocks from the Kraken exchange through the Binance Chain. Furthermore, as part of the collaboration, Backed will deploy the xStocks on the BNB Chain as BEP-20 tokens. This will give users seamless access to tokenized representations of US stocks and ETFs.

This will include crypto stocks like TSLA and other major stocks like AAPL, SPY, and NVDA. Binance founder Changpeng “CZ” Zhao also commented on this Kraken partnership, welcoming the exchange and Backed to the BNB Chain ecosystem.

In another X post, he jokingly welcomed the stock market to the BNB Chain and the network to the stock market. This move represents a huge boost for the network in terms of adoption. The network will join Solana as the only chains that offer support for these tokenized equities.

US President Donald Trump is amplifying calls for a Fed rate cut, eyeing a tapering of at least 300 bps while taking swipes at Jerome Powell.

Donald Trump Wants A Sharp Fed Rate Cut

US President Donald Trump has fired another barrage of criticism at the Federal Reserve, urging a swift Fed rate cut ahead of July’s FOMC meeting. In a Truth Social post, the US President noted that the country’s interest rates are “at least 3 points too high,” requiring urgent action.

He argues that Fed Chair Jerome Powell is costing the US nearly $1 trillion in economic losses by refusing to taper interest rates. The US President goes on to brand Powell “too late” with the latest salvo coming after Trump urged Powell to resign and face a Congressional investigation.

“Too Late is costing the U.S. 360 Billion Dollars a Point, PER YEAR, in refinancing costs,” said Trump.

Trump is backing his decision for a 300-basis-point Fed rate cut on waning inflation figures and the influx of fresh capital into the US. However, Powell has defended the Fed’s stance to keep interest rates steady, casting blame on inflationary risks from Trump’s tariffs. In a separate post, Trump shared research by the Council of Economic Advisers (CEA) in support of his claims that tariffs had zero impact on inflation.

📊 Markets

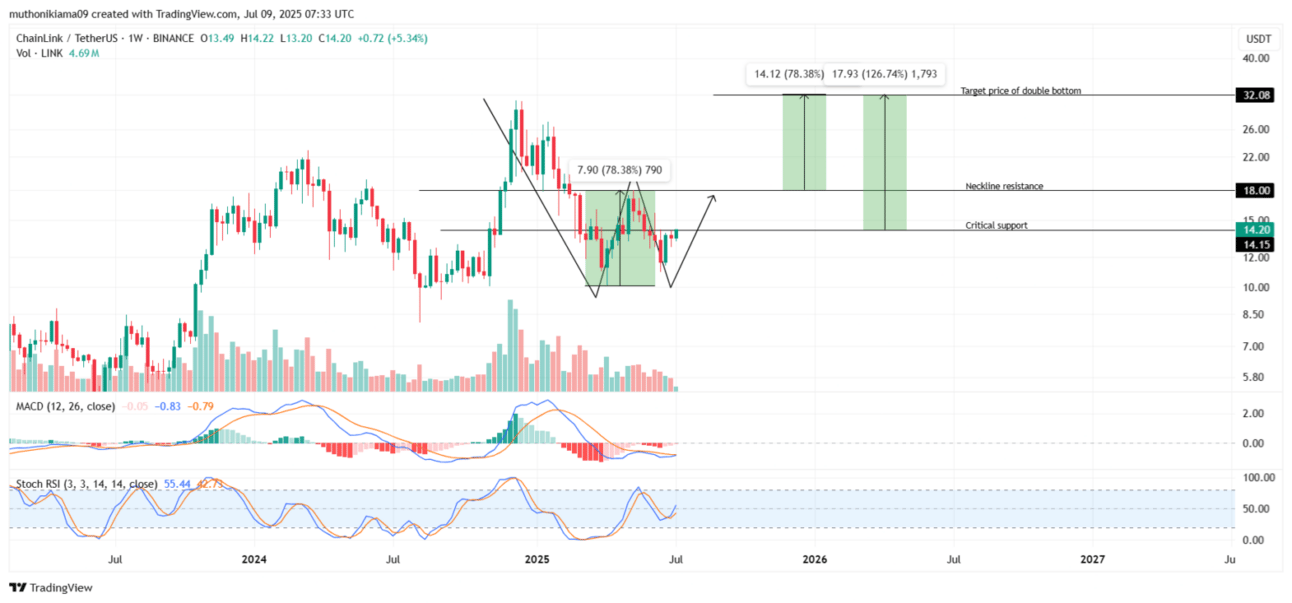

Explore why Chainlink price might be headed to $32 amid a bullish double-bottom pattern and a spike in the 30-day MVRV to monthly highs.

Chainlink Price on the Verge of a 126% Rally

Chainlink is emerging as one of the crypto tokens that might perform quite well in July 2025, following the emergence of a double-bottomed pattern on the weekly time frame chart. This pattern shows that bulls have been defending the support level at $10, and if it does hold, it might be a major factor that will drive a price rally.

LINK price has bounced from this support two times now, and the bullish traders are now targeting the resistance level that stands at $18. If it is successful in defending it, this might trigger a strong price increase, whereby the token will record a 126% gain to $32.

This double bottom pattern is still in the early stages, and it will mature after the price crosses above $18 and turns this price level into a strong support. However, a gradual increase in buying activity is supporting a bullish Chainlink price prediction.

The stochastic RSI has been rising slowly, and it has moved above 50 for the first time in one month, which indicates that the momentum is now in favor of bullish traders. Making a higher high will show that this bullish momentum is strong, and it is possible that the price of Chainlink will move higher.

Pepe Coin price is risking a 50% crash to $0.00000480 amid a bearish flag pattern and the sale of over 1 trillion PEPE tokens by whales.

Whales Dump 1 Trillion PEPE Tokens

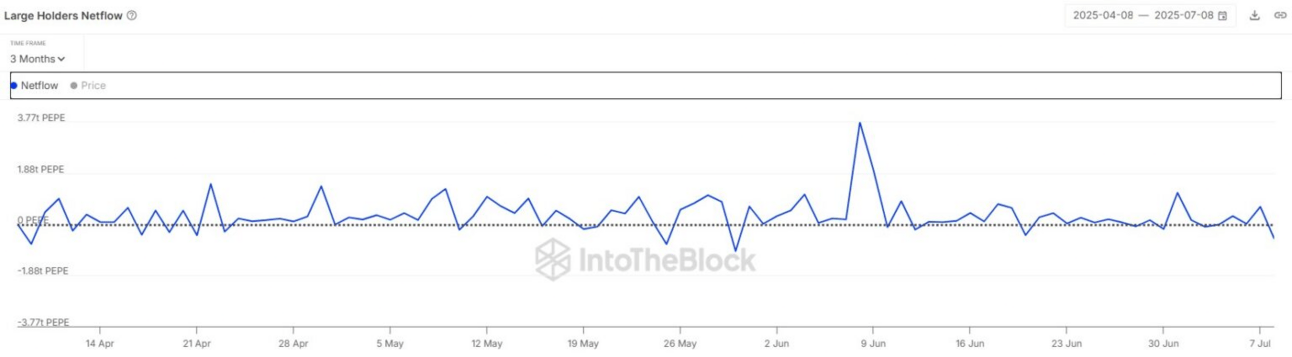

PEPE whales could be getting ready to sell their tokens and reduce the possibility of making losses, as seen in the decline of their holdings. IntoTheBlock data shows that in just 24 hours, whales have sold more than 1.16 trillion tokens after the balance of their wallets dropped from 647 billion to -521 billion tokens.

When whale wallets are no longer buying tokens and have decided to sell, it might show that they are expecting the price to drop. This behaviour comes alongside the formation of the bearish flag pattern on the daily chart.