- CoinGape Newsletter

- Posts

- 🚨 DeFi & Blockchain Daily: What’s Moving On-Chain

🚨 DeFi & Blockchain Daily: What’s Moving On-Chain

Your front-row seat to the biggest gains, boldest calls, and breaking stories in crypto—delivered daily.

🚀 Trending

Gary Gensler Is Proud of Crypto Enforcement Actions

Gary Gensler continues to resist crypto innovation, not happy with how the SEC has taken a 180-degree turn toward the crypto industry under Paul Atkins. CNBC host highlighted that the SEC is reversing a lot of his decisions, especially on crypto and AI.

Gensler said he is really proud of what he has accomplished during his tenure, including reforms and decisions in terms of investor protection. He claims he was right about securities and enforcement actions in the crypto market.

Notably, the SEC under Gensler filed lawsuits against all crypto giants, such as Binance, Coinbase, and Kraken, while continuing its legacy lawsuit against Ripple. Paul Atkins-led SEC has ended all these lawsuits.

The crypto community often criticized Gensler for pressing crypto and not offering clear guidelines and rules for the industry. Crypto leaders stressed that he didn’t even work towards investor protection and his priorities remained on defining crypto assets as securities.

📰 News

$4.5 Billion in Bitcoin and Ethereum Options to Expire Today

The latest Bitcoin options expiry will set the stage for the largest options expiry, which could shake the broader crypto market immensely.

30K BTC options with a notional value of $3.52 billion set to expire on the largest derivatives exchange Deribit, September 19. The put-call ratio is 1.23, indicating bearish sentiment as traders continue to place put bets in response to the quarterly expiry next week after the latest crypto market rally.

In the last 24 hours, the put-call ratio is at 0.77 as call volume surpasses 22,300 in comparison to a put volume of 17,250. This signals a cautious sentiment among options traders awaiting cues leading up to the next major expiry.

The max pain price is $114,000, way below the current market price. Options traders may look to bring BTC down towards the max pain point, with puts clustered around $100,000-108,000 strike price.

Meanwhile, over 177K ETH options of notional value $0.80 billion to expire on Deribit, with a put-call ratio of 1. It indicates bearish sentiment among traders and a likely drop in ETH price.

In the last 24 hours, the call volume was 66,142, slightly higher than put volume of 62,281 at publishing time. The put-call ratio is at 0.77.

Moreover, the max pain price is at $4,500, still below the current ETH price of $4,539. Notably, the $4,500 strike price has higher total call options bets of $22 million than $17 million in put options. This suggests a potential downward bias, as call buyers will likely aim to drive the price towards the level to minimize losses.

Trump Mulls New CFTC Chair Nominee

According to a Bloomberg report, the White House is considering additional candidates to lead the Commodity Futures Trading Commission, as the confirmation process for Quintenz stalls. Potential candidates for the role include government officials who are working on crypto policy.

This includes Michael Selig, who is a chief counsel to the SEC’s crypto task force. Tyler Williams has also emerged as a candidate for the CFTC chair role. He is currently a counselor to the U.S. Treasury Secretary Scott Bessent on crypto policy.

The confirmation process for Quintenz as CFTC chair has been rocky, with the White House asking the Senate Agriculture Committee, which supervises the CFTC, to pause the vote on his nomination. According to the report, this came after Tyler Winklevoss asked Trump to stop or delay the process for Quintenz’s confirmation.

Notably, the Winklevoss twins have played a crucial role in ushering in this pro-crypto administration, having donated to the U.S. president’s campaign last year. The Gemini co-founders have also continued to back Trump’s crypto push, recently donating $21 million to pro-crypto Digital Freedom Fund PAC.

Earlier this month, the CFTC chair nominee Quintenz said in an X post that he believes that Trump might have been misled. He further posted messages that included Tyler Winklevoss’ questions regarding his prior litigation with the CFTC. Quintenz further remarked that he looks forward to continuing to support the U.S. president and his agenda in whatever capacity he can.

📊 Market

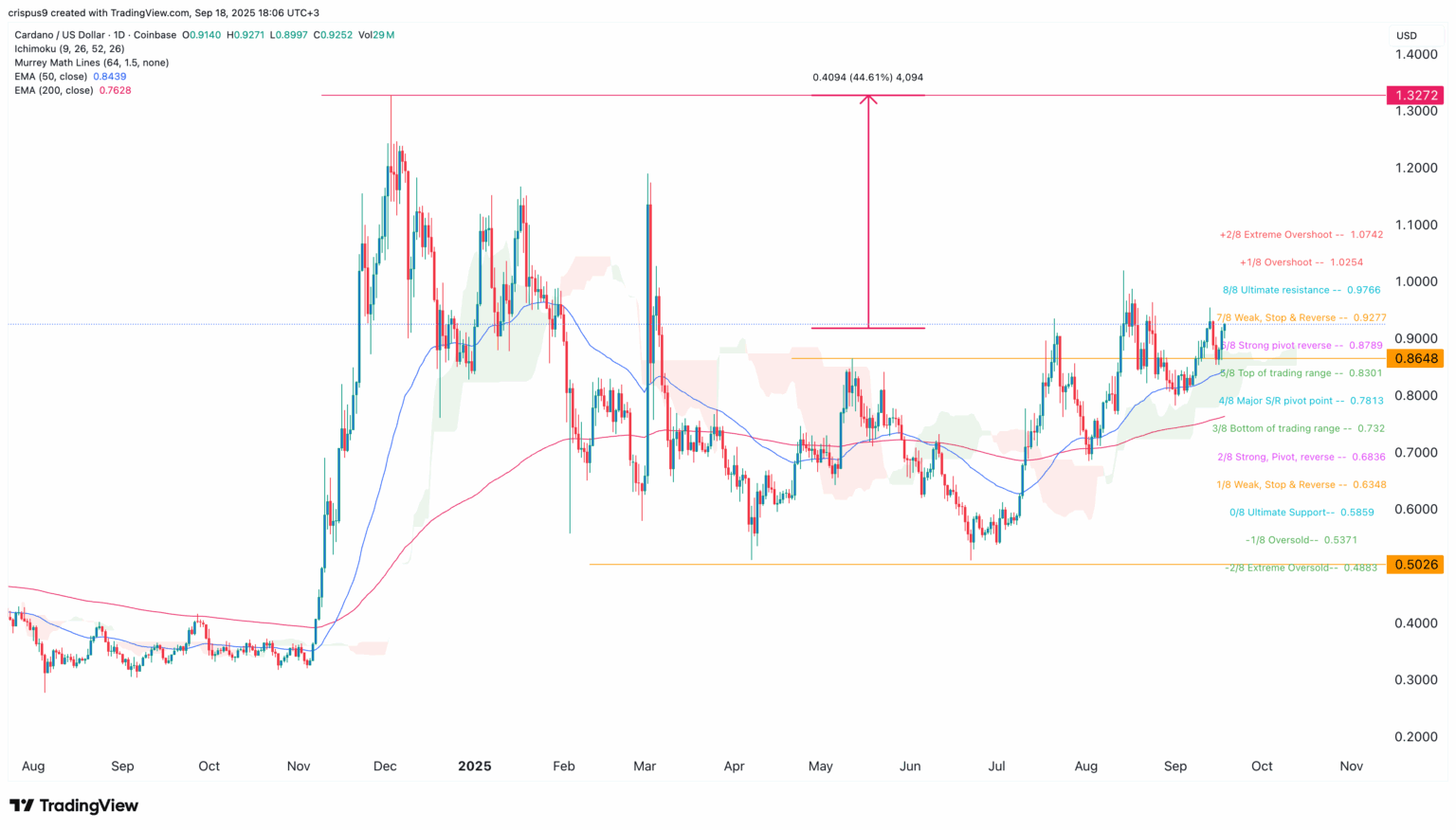

Cardano Price to Benefit from the Upcoming ADA ETF

One of the most significant catalysts for the Cardano price is the indication that the Securities and Exchange Commission (SEC) is poised to approve several crypto ETFs.

One of signs for this happened on Wednesday when the agency approved the generic standards for altcoin listing that will enable faster launching of crypto funds. The main criteria is that the funds will need to have a Coinbase futures product, and Cardano is part of this list.

The SEC has set aside October 22 as the final deadline for the approval of the Grayscale ADA ETF. According to Polymarket, the odds that the agency will approve this ETF on or before that day have jumped to 87%.

A Cardano ETF approval is likely because the agency has already approved multiple spot Ethereum ETFs, including by companies like Franklin Templeton and BlackRock. It is also a popular Made in America coin.

The approval will be a positive thing for Cardano, a blockchain network that has gone through a tough period in the past few years.

Unlike other networks like Solana, Sui, and Sei, Cardano is largely a ghost chain with no major applications in the ecosystem. It also does not a major market share in the stablecoin industry.

369

Is SHIB Price Replaying Its Historic Breakout Cycle Again?

As highlighted by a market analyst, the previous SHIB cycle rally started with steady accumulation before an explosive breakout that carried the price above $0.00004800. On the 4-hour chart, the move was characterized by a sequence of strong green candles that lifted the Shiba Inu price rapidly from early March lows near $0.00001800.

The rally peaked within days, printing a long upper wick as profit-taking set in and momentum slowed. However, the structure of this rally showed a textbook wave pattern, with a steep impulse phase. This was followed by measured corrections, eventually stabilizing above $0.00002800.

This pattern became a reference point for analysts, highlighting SHIB’s ability to deliver outsized gains once consolidation zones are cleared. Furthermore, meme coins as a group tend to amplify moves when speculative flows re-enter, which could further accelerate the path higher.

Currently, SHIB price is trading around $0.00001321, and the latest fractal mirrors that earlier setup. The chart again outlines an 80-week structure that suggests history could repeat, projecting potential highs near $0.0000457 if the wave count plays out.

The latest candles remain compressed within a blue-circled range, resembling the pre-breakout stage of the last rally. A decisive move above $0.000018 could act as the first confirmation of renewed upside strength.

CoinGape recently predicted that SHIB could rally by 160%, translating to a potential target of $0.000035, which aligns closely with the fractal-based forecast. Therefore, while SHIB consolidates now, the long-term SHIB price forecast retains its bullish bias, provided resistance levels are overcome with strong volume.