- CoinGape Newsletter

- Posts

- 🚨 On-Chain Today: Key Blockchain & DeFi Developments

🚨 On-Chain Today: Key Blockchain & DeFi Developments

Your front-row seat to the biggest gains, boldest calls, and breaking stories in crypto—delivered daily.

📰 News

Analyst Sees XRP Doubling by November

Prominent crypto analyst EGRAG Crypto has predicted that the altcoin may surge toward the $6–$7 range before mid-November. His forecast is based on fractal analysis, where recurring chart patterns suggest bullish continuity.

Although such models are not guarantees, they have gained traction among traders looking for repeatable signals in volatile markets. The projection comes as the token builds bullish momentum.

For example, the upcoming launch of the REX-Osprey XRPR ETF has given the altcoin fresh legitimacy in the U.S. markets. Along with cash, Treasuries, and derivatives, the fund, which was set up in accordance with the ’40 Act,’ directly holds XRP. The token itself receives about 80% of the assets.

This makes it the first U.S.-listed spot ETF offering direct exposure to the token. This could mark a pivotal moment for investors seeking regulated access. Analysts note that such products could attract significant institutional inflows.

It is also worth mentioning that there has been a recent drop in the reserve of the token on a major crypto exchange. Coinbase’s visible XRP cold storage holdings have dropped nearly 90% between June and September 2025. Analysts have speculated about the reasons for this, with many stating that it was sold off.

REX-Osprey Dogecoin and XRP ETFs Officially Launch

In a press release, REX-Osprey unveiled the launch of the DOJE and XRPR ETFs, which will be the first U.S.-listed funds to provide investors with spot exposure to DOGE and XRP.

The asset managers noted that DOJE marks the first-ever Dogecoin ETF, as there is yet to be a futures-based fund for the top meme coin. As Bloomberg analyst Eric Balchunas pointed out, it will also be the first U.S. fund to provide exposure to an asset that doesn’t exactly have any utility.

As CoinGape earlier reported, these Dogecoin and XRP ETFs are launching under the 40 Act and won’t hold 100% spot. Some of these funds’ holdings will include other spot DOGE or XRP ETFs, which will help provide investors with exposure to these altcoins.

Commenting on the launch of these funds, Greg King, CEO and founder of REX Financial and Osprey Funds, said that the digital asset revolution is already underway and that they are proud to be able to offer exposure to some of the most popular digital assets under the 40 Act ETF regime.

Notably, the launch of these Dogecoin and XRP ETFs follows the launch of the REX-Osprey Solana staking ETF, which was the first to offer spot SOL exposure with on-chain staking rewards. The fund has surpassed $275 million in assets under management (AuM).

Market expert Nate Geraci also highlighted the launch of the DOJE and XRPR ETFs in an X post. Geraci has, before now, predicted that the XRP ETFs will record significant demand based on the success that the CME futures and futures-based ETFs have enjoyed so far.

Meanwhile, it is worth mentioning that the SEC already approved Grayscale’s GDLC, which, although not a full-fledged XRP ETF, will hold the altcoin and offer investors spot exposure.

📊 Market

Is Hedera Price Ready for a Major Breakout After Holding Key Levels?

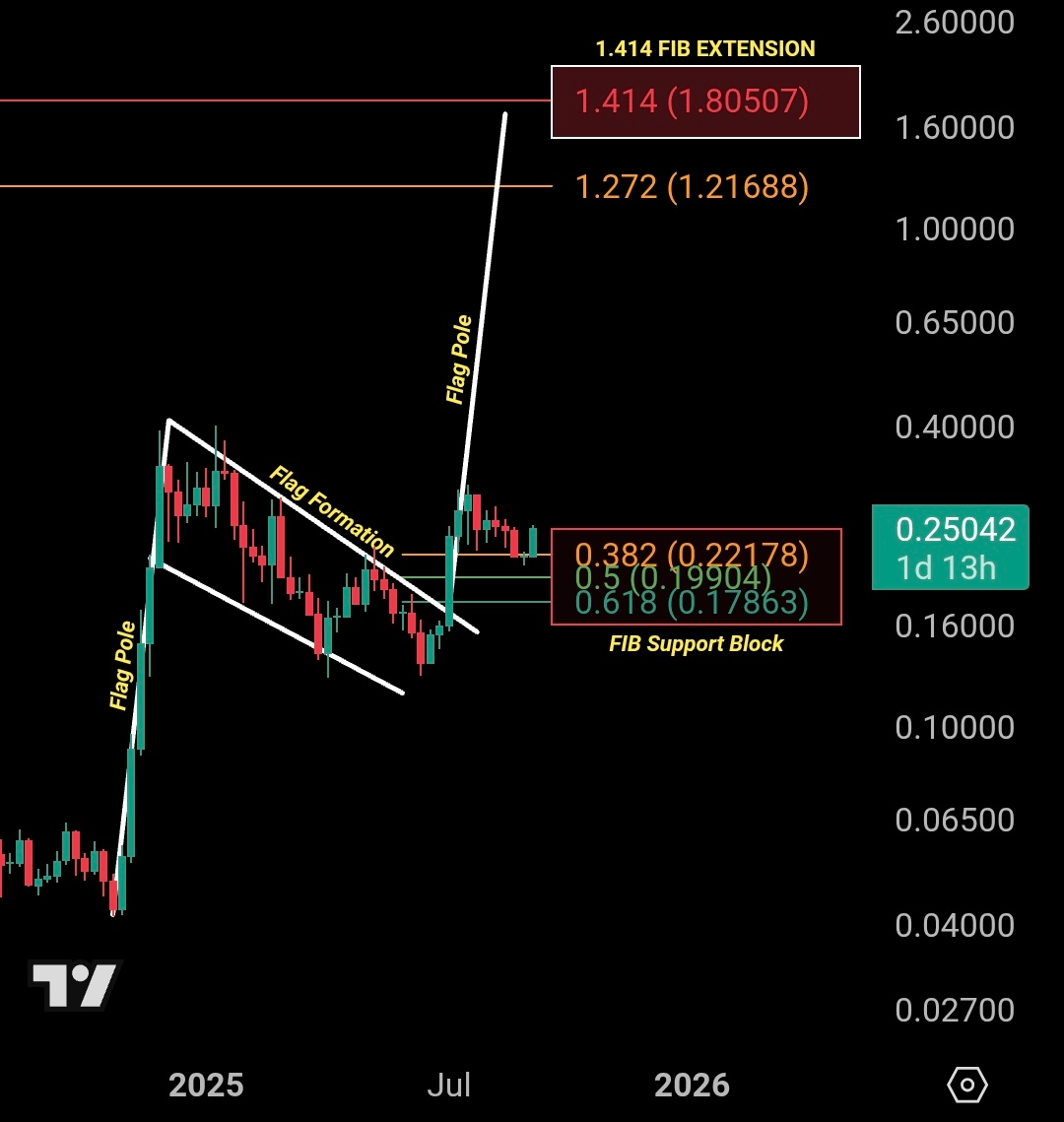

HBAR price recently rebounded from the 0.382 Fibonacci support zone around $0.22, reinforcing a bullish setup as highlighted by a market analyst. Hedera price currently trades near $0.25, maintaining stability above key retracement levels that act as strong support.

A flag formation breakout earlier this year hinted at continued upside, with technicals now pointing to sustained accumulation. If buyers protect the $0.22 level, the next resistance lies near $0.40, followed by a broader extension toward $0.65.

Beyond these, Fibonacci projections suggest $1.21 as an achievable medium-term target, while the analyst long-term HBAR price forecast aligns with $1.80. This path remains valid as long as HBAR sustains its higher lows.

CoinGape earlier predicted that speculation over a potential HBAR ETF could help drive the token toward the $0.50 zone, a view now reinforced by ongoing technical strength.

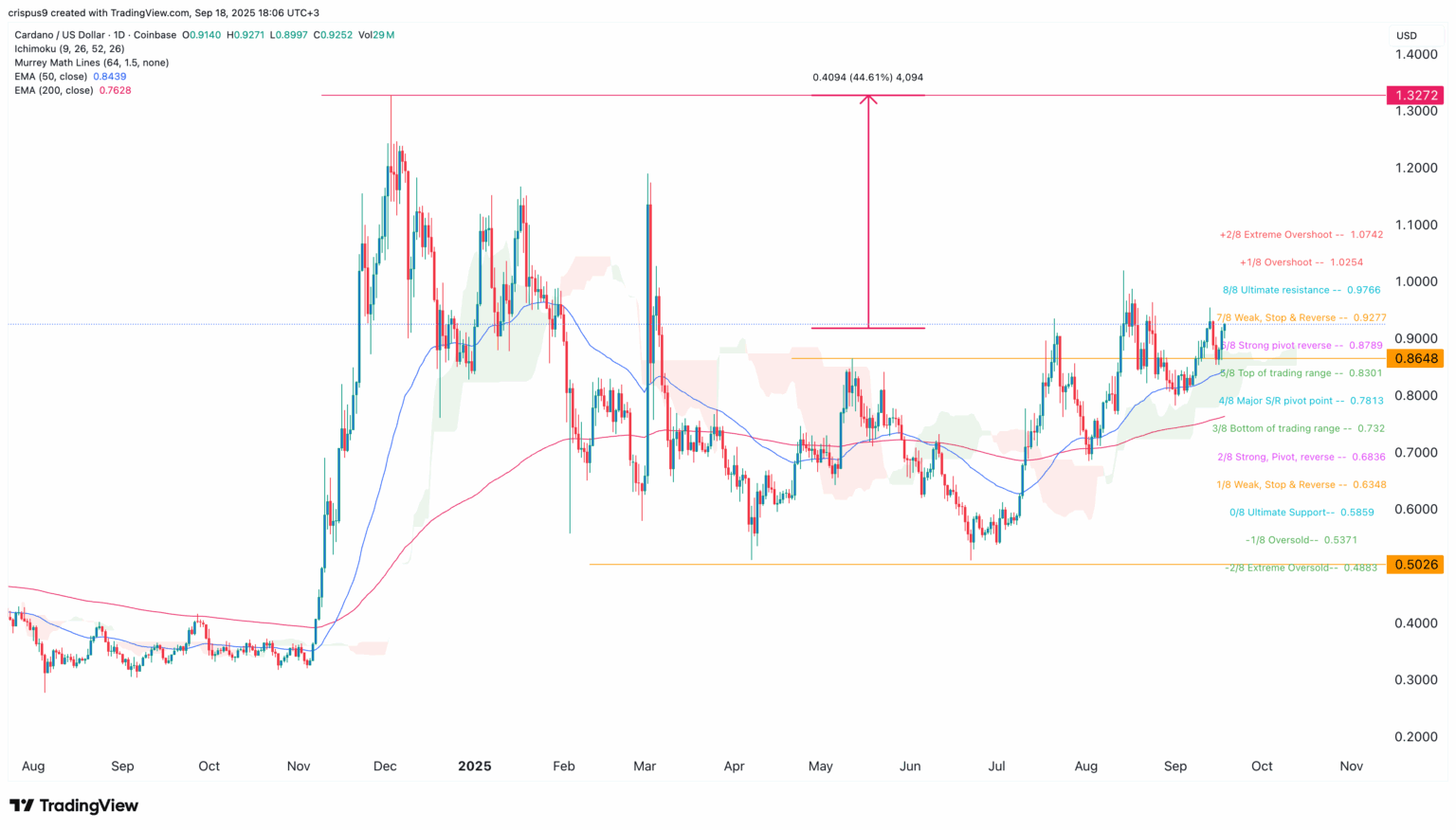

Cardano Price to Benefit from the Upcoming ADA ETF

One of the most significant catalysts for the Cardano price is the indication that the Securities and Exchange Commission (SEC) is poised to approve several crypto ETFs.

One of signs for this happened on Wednesday when the agency approved the generic standards for altcoin listing that will enable faster launching of crypto funds. The main criteria is that the funds will need to have a Coinbase futures product, and Cardano is part of this list.

The SEC has set aside October 22 as the final deadline for the approval of the Grayscale ADA ETF. According to Polymarket, the odds that the agency will approve this ETF on or before that day have jumped to 87%.

A Cardano ETF approval is likely because the agency has already approved multiple spot Ethereum ETFs, including by companies like Franklin Templeton and BlackRock. It is also a popular Made in America coin.

The approval will be a positive thing for Cardano, a blockchain network that has gone through a tough period in the past few years.

Unlike other networks like Solana, Sui, and Sei, Cardano is largely a ghost chain with no major applications in the ecosystem. It also does not a major market share in the stablecoin industry.

369