- CoinGape Newsletter

- Posts

- 🚨 The Week in Blockchain: Headlines That Matter to Traders

🚨 The Week in Blockchain: Headlines That Matter to Traders

Your front-row seat to the biggest gains, boldest calls, and breaking stories in crypto—delivered daily.

📰 News

Bitget and Ondo Finance Bring 24/7 Access to Global Stocks and ETFs

The integration allows users to trade tokenized versions of companies like Apple, Tesla, Microsoft, Amazon, and Nvidia. Based on the press release, popular ETFs are also included. All assets are denominated in U.S. dollars and are available for 24/7 trading. Access depends on regional regulations, excluding some U.S. users.

Through the new real-world asset (RWA) module, Bitget Onchain and Bitget Wallet users can browse, analyze, and trade assets with as little as one dollar. All the tokens reflect the performance of their underlying stocks or ETFs, such as price and dividends.

Regulated custodians guarantee that protection for investors. Also, Bitget Wallet has partnered with Mastercard and Immersve to launch a zero-fee crypto card.

Unlike a variety of tokenized products whose operation is dependent on an onchain liquidity pool, Ondo Finance is directly connected to traditional equity markets. This offers the ability to execute efficiently like major stock exchanges using the Global Markets infrastructure provided by Ondo. This is already available on Ethereum, and with plans to expand to Solana and BNB Chain.

The collaboration extends Bitget’s CeDeFi ecosystem, offering users exposure to global markets without needing brokers or banks. Both Bitget exchange and its wallet team plan campaigns to drive adoption of tokenized assets. Bitget Wallet also aims to expand its catalog to more than 1,000 stocks and ETFs in the coming months.

Crypto On Top Of The List Of SEC Spring Agenda

The agency’s rule list for Spring 2025 includes a proposed rule change for crypto assets. Specifically, the Rulemaking Division is considering recommending that the Commission propose rules that relate to the offer and sale of crypto assets, potentially including certain exemptions and safe harbors.

This is to help clarify the regulatory framework for crypto assets and provide greater certainty to the market. In line with this, the SEC also called for questions and public comment on the proposed rule change for crypto assets. Wintermute already submitted feedback to the Crypto Task Force on tokenized securities.

The Commission failed to mention a deadline to implement these proposed rule changes, although it listed the framework as one that will be major for the crypto industry. Notably, since taking office, SEC Chair Paul Atkins has prioritized regulatory clarity for the crypto industry, aligning with President Trump’s vision to make America the crypto capital.

In July, Atkins announced the launch of ‘Project Crypto’ to modernize securities rules and move markets on-chain. Meanwhile, the SEC and CFTC recently released a joint statement in which they opened the door to spot crypto on U.S.-regulated exchanges.

Join 2,000+ investors earning passive BTC income from industrial-scale mining — without the $50K+ entry cost.

✅ Start with just $100

✅ No setup, no tech headaches

✅ 70% lower electricity costs

✅ Get monthly Bitcoin payouts

✅ Always upgraded hardware — no extra cost

⏳ Only 72 hours left before the next stage price hike. Limited spots remain!

📊 Market

SUI Price Action: Breakout Patterns Build Across the Charts

On the weekly chart, SUI price has built a rising base through an ascending triangle, holding firm above $3.10 across several tests. Each bounce off support has added pressure to the $4.30 barrier, which continues to act as the gatekeeper for higher levels with the SUI current value trading at $3.31.

According to an analyst on X platform, a breakout above this ceiling could spark a run toward $10, aligning with the measured target of the triangle. The pattern reflects steady absorption of sell pressure, with green candles forming after each dip.

Buyers appear willing to step in repeatedly, reinforcing the base. If $4.30 finally cracks, the structure favors a swift climb as liquidity thins above.

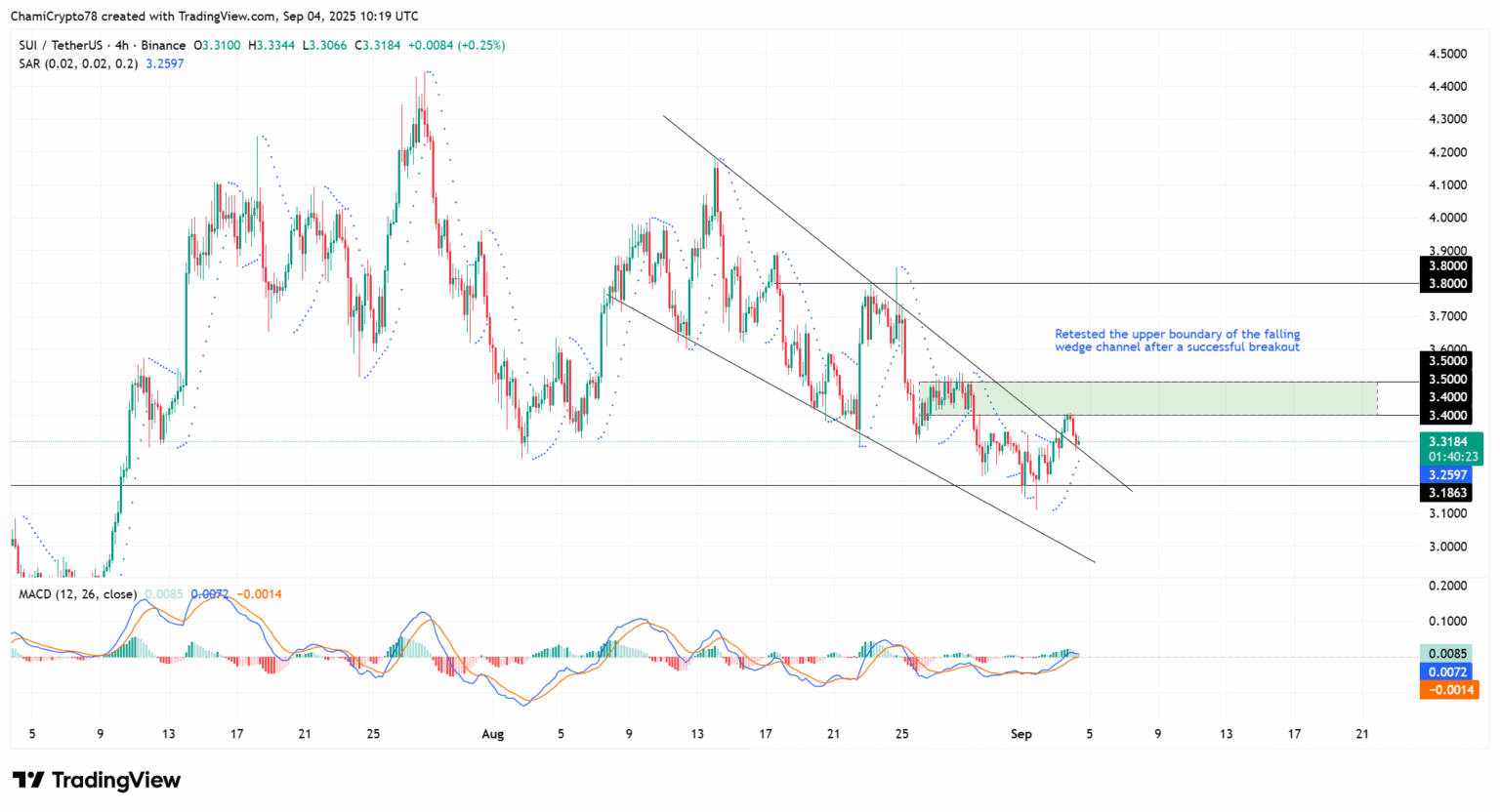

On the 4-hour chart, the picture has strengthened further after price broke out of a falling wedge and retested the upper boundary around $3.25. This retest provided clean confirmation, flipping the level into fresh support before the next advance.

The breakout has opened a pathway toward $3.50–$3.80, identified as a critical near-term zone. Parabolic SAR dots now sit beneath the candles, while MACD lines have crossed into positive territory, both adding weight to the bullish case.

Holding above $3.18 remains essential, since losing that ground would weaken this setup. With confirmation of the wedge retest and improving technicals, the structure now leans heavily toward continuation.

Importantly, the long-term SUI price outlook remains constructive, supported by strengthening technical structures across multiple timeframes.

Top Catalysts that Will Boost Ethereum Price to $5k

Ethereum price could be on the verge of more gains to $5,000, helped by numerous catalysts. The first major catalyst is that there is still interest in Ethereum assets.

In a statement, Grayscale, a top asset manager in the crypto space, filed for the Ethereum Covered Call Fund, which will enable users to generate regular income from their investments.

Covered call ETFs generate high dividends by investing in an asset and then selling their call options. They then receive a premium, which they then distribute to investors.

Ethereum price may also jump as whales have continued to buy the tokens. One whale bought tokens worth $100 million on Thursday, a sign that he expects the upward trajectory to continue.

Whale buying is usually a bullish sign because these investors are seen as being more experienced and sophisticated than retail ones. They also have more skin in the game.

Further, the value of ETH will continue doing well as it outperforms other related blockchains like Solana, Tron, and BNB Smart Chain. A good example of this is in the decentralized finance (DeFi) industry, where Ethereum has a market dominance of over 70%.

DeFi applications on the network, like Aave, Uniswap, and Lido have the biggest market share in their respective industries. For example, all DEX platforms on Ethereum handled tokens worth over $3.6 billion in the last 24 hours. The network’s stablecoin supply has also soared to a record high of $150 billion.