- CoinGape Newsletter

- Posts

- 🚨 Today in Crypto: News You Can’t Miss

🚨 Today in Crypto: News You Can’t Miss

📰 News

The US Supreme Court has ruled against Coinbase users in the IRS case, allowing the tax agency to have access to their data on the exchange.

US Supreme Court Rules Against Coinbase In IRS Case

According to the Bloomberg report, the court refused to question whether the Internal Revenue Service (IRS) had the authority to issue a summons that forced Coinbase to release the transaction information of over 14,000 customers.

The US Supreme Court justices reportedly failed to explain why they rejected the appeal from the Coinbase user who had appealed the legality of the IRS summons. The user argued that the IRS had violated his rights under the Constitution’s Fourth Amendment by accessing his data through the top crypto exchange.

Specifically, the Coinbase user, James Harper, asked the court to revisit a 1976 ruling that stated customers don’t have privacy rights regarding records held by their banks. This Supreme Court decision, therefore, upholds that 1976 ruling and suggests that this rule will still apply to crypto platforms that provide financial services.

Robinhood is working on its own blockchain, an Arbitrum layer 2 solution for its stock token issuances as HOOD stock surges.

Robinhood Teams Up With Arbitrum, Builds L2 Blockchain

Robinhood has disclosed that it is building a layer 2 blockchain on Arbitrum, optimized for tokenized real-world assets. According to an official announcement, Robinhood will deploy the incoming Arbitrum-based L2 blockchain for tokenized stock issuances.

The company announced the development at the “Robinhood Presents: To Catch A Token” event in France, unveiling a raft of products. Per the statement, Robinhood has launched tokenized US stock and ETF tokens, allowing users in Europe to access up to 200 US securities.

For starters, Robinhood will issue stock tokens on Arbitrum until its blockchain development is complete. Afterwards, all stock and ETF tokens will be facilitated on the new blockchain based on Arbitrum, offering 24/7 trading and self-custody.

The blockchain functionalities will enable Robinhood users to receive payment dividends on the app. Early in the day, the Arbitrum price jumped by 30% following speculation of an imminent partnership.

📊 Markets

Arbitrum price eyes another 70% rally to $0.76 amid a rumored partnership with Robinhood and surging on-chain activity.

Why is Arbitrum Price up 30% This Week?

Arbitrum price has been on a massive upward trend in the last seven days, with CoinMarketCap data showing that its value is up by nearly 30% during this time. The bullish momentum has seen the price surge from $0.26 to $0.36.

The ongoing rally is being influenced by a combination of bullish factors, including:

Rumored strategic partnerships

Strong on-chain data

Increased participation by market makers

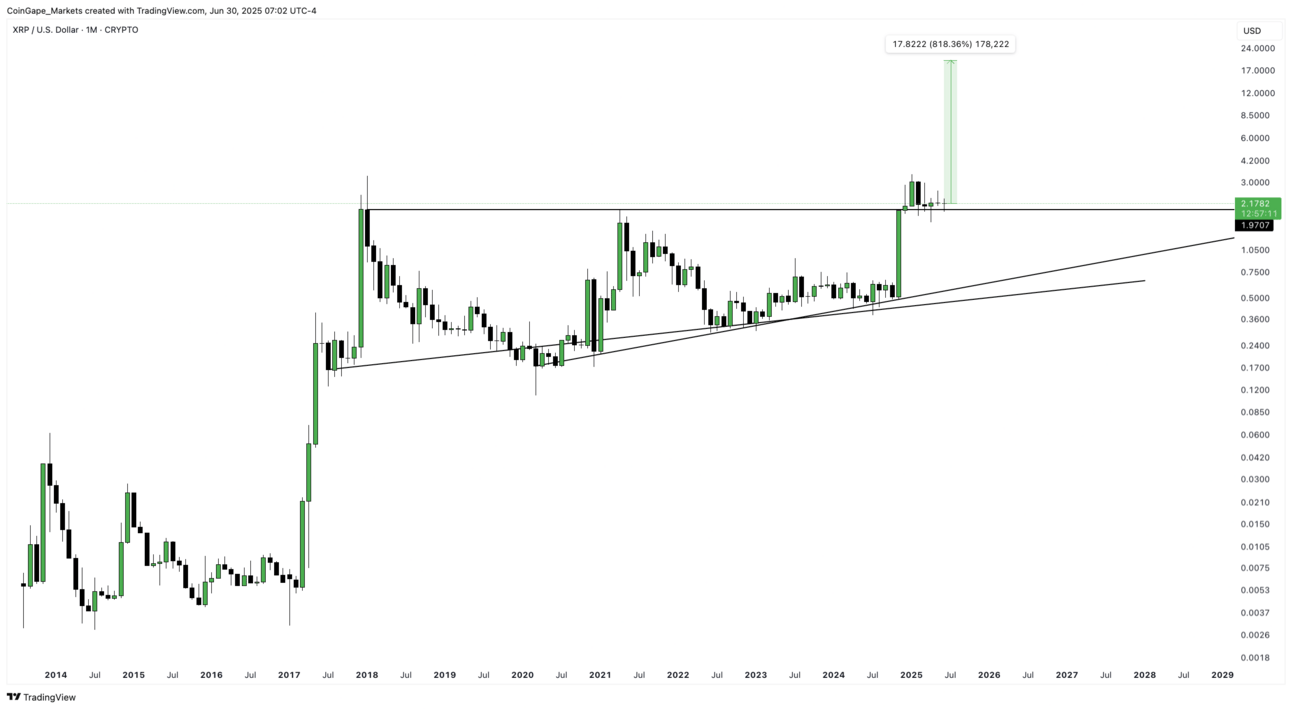

XRP price prediction if Bitcoin hits $1 million and its market cap $20 trillion. Do fundamentals support a $20 per token target?

XRP Price Impact if Bitcoin Hits $1M

Before we dive into the calculations and impact of $1M per BTC impact on the XRP token, let’s take a look at a few Bitcoin price predictions.

Cathie Wood, CEO of ARK Invest, predicts a bull case of $1.5 million by 2030. Robert Kiyosaki added that while Bitcoin price may seem expensive at $107K, he would regret not buying more “if and when” it hits $1M in the future. In his previous predictions, Kiyosaki wrote that $1M per BTC would be possible by 2035. Eric Trump stated in December 2024 that Bitcoin would reach $1 million per token, citing its potential to transform the global economy.

Many experts and investors have often regarded Bitcoin as the tide that lifts all boats. Here, the anomaly compares boats to altcoins, saying that if BTC climbs, altcoins will follow suit. With this analogy, if the Bitcoin price were to hit $1 million in this bull run, it would mean BTC would need to increase by 9.34 times from its current position of $107K. This move would increase BTC’s market capitalization of $2.13 trillion, according to CoinGecko data, to $19.89 trillion.

For simplicity’s sake, let’s assume a 10x increase in BTC price, while the market cap increases from $2 trillion to $20 trillion. Assuming the ratio of the market cap of XRP and BTC remains the same at 6%, the forecasted price of XRP would be $20.32, or roughly $20. This calculation also assumes that the circulating supply of XRP remains constant at 59 billion.

XRP would need to grow nearly 10x from its current price of $2.17 to reach the forecasted target of $20.