- CoinGape Newsletter

- Posts

- 💰 XRP $45 Prediction? Bitcoin Might Have to Watch From the Sidelines 🚀

💰 XRP $45 Prediction? Bitcoin Might Have to Watch From the Sidelines 🚀

Your front-row seat to the biggest gains, boldest calls, and breaking stories in crypto—delivered daily.

📰 News

Robert Kiyosaki Says Buy The Dips During Bitcoin Crash

Renowned investor Robert Kiyosaki has issued a fresh warning about potential financial turbulence, stating that “bubbles are about to start busting.” His comments come as the total outstanding US national debt soars to $37 trillion, while Treasury yields continue to rise, showing fragility in the US economy. Additionally, June’s US CPI numbers suggest that inflation remains sticky.

In a recent post, Kiyosaki suggested that major asset classes, such as gold, silver, and Bitcoin, could also experience sharp corrections as broader market bubbles begin to deflate. However, Kiyosaki framed the potential downturn as a buying opportunity. “If prices of gold, silver, and Bitcoin crash… I will be buying,” he said.

Following the Bitcoin price all-time high last week, Robert Kiyosaki stated that the cryptocurrency will soon enter a banana zone, and a FOMO-driven retail buying could lead to a potential correction. BTC is already down more than 5% from its all-time highs and is currently trading around $118,000.

Key Takeaways:

Robert Kiyosaki warns that financial bubbles across markets are about to burst.

US national debt has reached $37 trillion with rising Treasury yields.

June CPI data shows inflation is still persistent.

Kiyosaki expects corrections in gold, silver, and Bitcoin.

He views the potential crash as a buying opportunity.

Kiyosaki predicts a “banana zone” for Bitcoin as retail FOMO sets in.

Bitcoin is currently down over 5% from its all-time high, trading around $118,000.

Charles Hoskinson Reveals Timeline For Cardano Audit Report

In an X post, Cardano founder Charles Hoskinson has disclosed plans for the imminent release of an audit report into the handling of ADA tokens from 2021. The audit report seeks to reveal the ADA holdings of Hoskinson’s Input Output Global (IOG), the firm behind the Cardano blockchain.

Hoskinson says he has received the first copy of the audit report but is pushing for more details in key areas before a public reveal. The Cardano founder is eyeing a mid-August release for the audit report if every goes according to plan.

I just received the first copy of the audit report. I requested a lot more detail and context in several areas, but it's shaping up quickly. I believe we are on schedule for a mid-August release, assuming the work continues at this pace and there are no delays.

I will read the

— Charles Hoskinson (@IOHK_Charles)

1:04 AM • Jul 20, 2025

Hoskinson is pushing for full transparency with the release of the audit, pledging to read the entire report via livestream. Furthermore, Hoskinson says a dedicated website will host the report and will be available for the Cardano community to access.

“I just received the first copy of the audit report,” said Hoskinson. “I requested a lot more detail and context in several areas, but it’s shaping up quickly.”

Input Output Global Chief Legal Officer Joel Telpner reiterated Hoskinson’s statement on the timeline of the release. However, Telpner did not disclose the name of the law firm and audit firm handling the investigation.

Amid Hoskinson’s disclosure, Cardano price rallied 4.19% to trade at $0.86, joining the rest of the crypto market rally.

Key Takeaways:

Charles Hoskinson confirms ADA audit is underway and plans a mid-August public release.

He promises full transparency, including a livestream read-through and a public website.

Legal team supports the timeline, but audit firms remain unnamed.

ADA price jumped 4.19% to $0.86 after the news.

Why Most Miss Out on Bitcoin Mining — And How BitFrac Changes the Game

The Struggle:

– Entry cost? $50K+

– Zero tech skills = zero chance

– Power bills eat up profits

– Gear becomes obsolete fast

– No passive income — it’s a grind

BitFrac's Game-Changer:

– Start mining with just $100

– 100% hands-free, fully managed

– Slash energy costs by 70%

– Auto-upgrade hardware with earnings

– Get monthly BTC straight to your wallet

No rigs. No hassle. Just real, passive Bitcoin rewards. Click HERE to know more.

📊 Markets

Expert Says XRP Price May Jump 1,300%

Well-known expert The Great Mattsby recently highlighted that the XRP price is showing a re-expansion of monthly Bollinger Bands, a pattern last seen before its historic rally in 2017. Back then, XRP soared an additional 1,300% during the breakout. Mattsby’s Gann-based chart analysis aligns this potential move to roughly $45 per XRP.

Despite its past challenges, XRP price momentum has been undeniable. At press time, XRP price trades at $3.5 with a market cap exceeding $207 billion, up over 63% in the past month. This also aligns with the growing activity on the XRP Ledger.

“Activity on the XRPL is growing rapidly. Daily active addresses have increased 7x, and transaction volumes have reached record levels. The XRPL now has more than 29,000 active addresses and over 10,000 unique traders”.

Further data shows that daily transactions exceeded 830,000. Trading in meme coins also brought in $6.25 million in volume. Stablecoin activity remains steady at around $5.6 million, while the total volume on decentralized exchanges (DEX) on XRPL reached over $12 million, showing good liquidity.

In summary, as the XRPL scales from payments into smart contracts and stablecoin remittances, experts believe the XRP price could be on the verge of a major surge.

Key Takeaways:

XRP shows Bollinger Band pattern last seen before 2017’s 1,300% rally.

Analyst targets $45 per XRP using Gann chart analysis.

XRP is trading at $3.5, up 63% in a month.

XRPL active addresses jumped 7x to 29K+.

Daily transactions hit 830K+, reaching all-time highs.

Meme coin trading on XRPL hit $6.25M volume.

Stablecoin activity steady at $5.6M; DEX volume crossed $12M.

Experts say XRP could explode as XRPL expands into smart contracts and remittances.

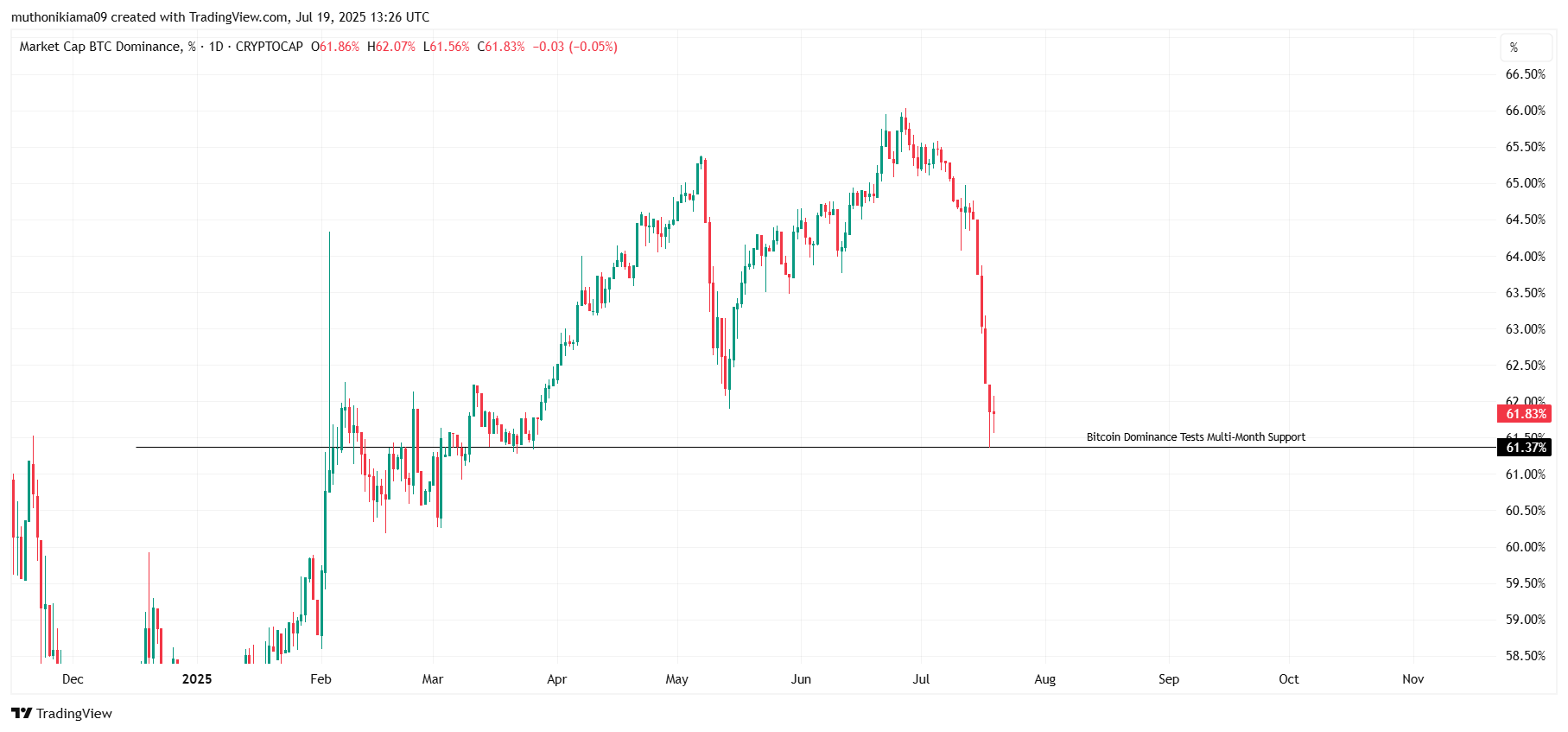

Ethereum Price Rallies as Bitcoin Dominance Crashes

The share of Bitcoin in the total $4 trillion crypto market cap has dropped in recent days as altcoins fill the gap, with investors rushing to invest in other coins that are well-positioned to deliver returns. The share of its market cap has dropped to 61%, marking its lowest level since March, as it records fewer gains.

The performance in the previous years shows that Ethereum usually steps up to fill this gap when the metric is dropping, and this is already being seen, considering that the ETH price is up by 21% in one week while BTC is up by only 0.6% within the same period.

This drop has also caused a surge in talks about the beginning of an altcoin season, considering that the index has risen to 41 to indicate that investors are moving their funds from Bitcoin to other crypto assets. This also supports the bullish narrative for an Ethereum price prediction.

When investor sentiment towards altcoins is more bullish than the sentiment towards BTC, the ETH price will likely continue the surge, with investors shifting to this altcoin with hopes that it will target new highs.

Key Takeaways:

Bitcoin dominance has dropped to 61%, its lowest since March.

Investors are rotating funds from BTC into altcoins.

Ethereum surged 21% this week, while BTC gained just 0.6%.

Altcoin Season Index rose to 41, signaling a shift toward alts.

Historical patterns suggest ETH gains momentum when BTC dominance falls.

Investor sentiment is turning more bullish on Ethereum.

ETH may target new highs if the altcoin rally continues.